Introduction

In today’s fast-paced world, managing your finances efficiently is more critical than ever. Fortunately, the integration of technology into the world of finance has given rise to a plethora of innovative gadgets designed to help you track, save, invest, and manage your money smartly. In this comprehensive guide, we will explore the top finance gadgets available in 2023, ensuring that you stay at the forefront of financial wellness. Our number one pick for the best finance gadget will be unveiled…

Why Finance Gadgets Matter

Before diving into the best finance gadgets, it’s essential to understand why these tools are vital for modern financial management. In this chapter, we’ll explore the benefits of using finance gadgets, including:

- Efficiency: Finance gadgets streamline financial tasks, saving you time and effort.

- Accuracy: Automation reduces the risk of human error in financial calculations.

- Financial Awareness: These gadgets provide insights into your spending and investment patterns.

- Security: Protect your financial data with advanced encryption and security features.

- Goal Achievement: Track your financial goals more effectively and stay motivated.

Budgeting Gadgets

Effective budgeting is the foundation of sound financial management. In this chapter, we’ll explore gadgets that help you budget efficiently. Our top pick for this category is the “Mint Budgeting App.”

1. Mint Budgeting App

Mint is the ultimate budgeting app that tracks your income, expenses, and financial goals effortlessly. It provides real-time insights into your financial health, includes features categorizes your expenses links, and sends you alerts for bills and unusual spending patterns. With a user-friendly interface and bank-level security, Mint is a must-have for anyone looking to master their finances.

In addition to these features, Mint also offers a detailed breakdown of your spending categories, allowing you to see precisely where your money goes. It provides valuable suggestions on how to reduce spending in specific areas and increase your savings. Moreover, Mint allows you to set and track your financial goals, whether it’s paying off debt, saving for a vacation, or building an emergency fund. The app also provides you with your credit score, making it a one-stop-shop for all your financial needs.

Saving and Investment Gadgets

Building wealth and securing your financial future requires smart saving and investing. In this chapter, we’ll explore gadgets to help you save more and invest wisely. Our top pick for this category is the “Acorns Investment App.“

2. Acorns Investment App

Acorns is a micro-investment app that rounds up your everyday purchases to the nearest dollar and invests the spare change in diversified portfolios. It’s an excellent way to start investing with small amounts of money and grow your wealth gradually.

But Acorns goes beyond spare change investing. It offers several investment portfolios designed to align with your financial goals and risk tolerance. Whether you’re saving for a rainy day, a new car, or retirement, Acorns has you covered. The app’s intuitive interface allows you to monitor your investment performance and make adjustments as needed.

Furthermore, Acorns offers a feature known as “Found Money,” where you can earn cashback on purchases from partner brands, which is then automatically invested for you. This unique feature makes saving and investing almost effortless.

Staying on top of your taxes and expenses is crucial for financial success. In this chapter, we’ll explore gadgets that simplify tax filing and expense tracking. Our top pick for this category is the “Expensify Expense Tracking App.”

3. Expensify Expense Tracking App

Expensify takes the hassle out of expense tracking and reporting. It allows you to scan receipts, track mileage, and categorize expenses effortlessly. Whether you’re a business owner or an individual, Expensify ensures you never miss a deductible expense and simplifies the tax filing process.

Expensify also offers a feature called “SmartScan,” which uses OCR (Optical Character Recognition) technology to extract information from your receipts automatically. This means you can say goodbye to manual data entry and paperwork. The app integrates seamlessly with popular accounting software and can generate detailed expense reports with just a few clicks.

For businesses, Expensify offers features such as corporate card reconciliation and policy enforcement, making it a valuable tool for managing expenses and maintaining compliance.

Credit Monitoring and Improvement Gadgets

Maintaining a healthy credit score is essential for accessing financial opportunities. In this chapter, we’ll explore gadgets that help you monitor and improve your credit. Our top pick for this category is the “Credit Karma Credit Monitoring App.”

4. Credit Karma Credit Monitoring App

Credit Karma offers free access to your credit scores, credit reports, and personalized credit improvement tips. It helps you monitor your credit health and provides insights into factors affecting your score. With Credit Karma, you can take proactive steps to boost your creditworthiness.

One standout feature of Credit Karma is its Credit Score Simulator, which allows you to see how different financial actions, such as paying off a credit card or opening a new account, may impact your credit score. This tool empowers you to make informed decisions about your financial activities.

Credit Karma also provides recommendations for credit cards and loans tailored to your credit profile, helping you find the best financial products to suit your needs.

Personal Finance Education Gadgets

Financial literacy is the key to making informed money decisions. In this chapter, we’ll explore gadgets that offer educational resources to enhance your financial knowledge. Our top pick for this category is the “Investopedia Finance Learning App.”

5. Investopedia Finance Learning App

:max_bytes(150000):strip_icc():format(webp)/DesktopNewsletterBanner-196883213f5c4294946e55606ef1da26.png)

Investopedia is a trusted source of financial information and offers a dedicated learning app. It provides articles, tutorials, and quizzes on a wide range of financial topics, making it easy to expand your financial knowledge at your own pace.

The Investopedia app covers everything from basic financial concepts to advanced investment strategies. It’s an excellent resource for individuals looking to improve their financial literacy, whether they are beginners or seasoned investors.

Investopedia also provides timely news and analysis on financial markets, helping you stay informed about economic trends that could impact your finances.

Security and Privacy Gadgets

Protecting your financial information is paramount. In this chapter, we’ll explore gadgets that enhance the security and privacy of your financial data. Our top pick for this category is the “YubiKey Security Key.”

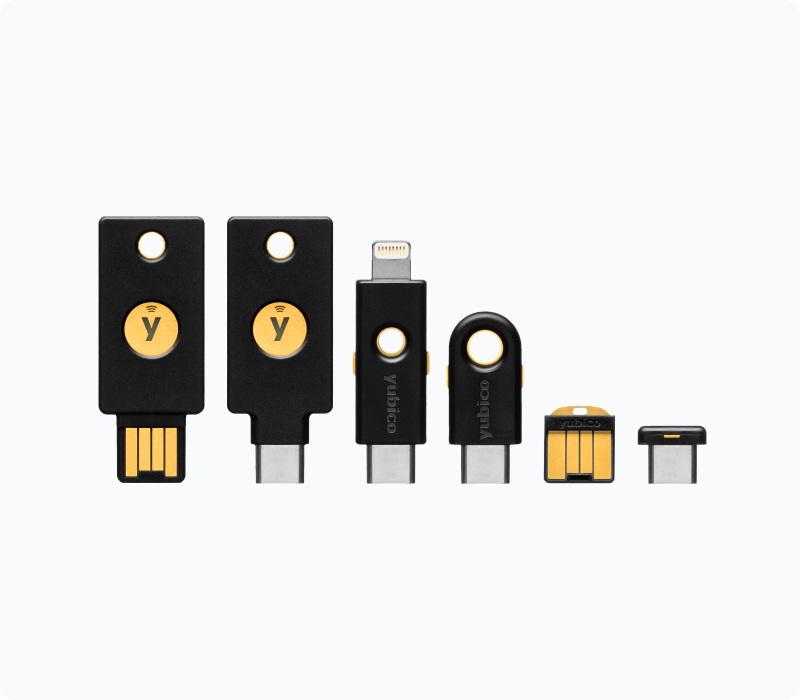

6. YubiKey Security Key

YubiKey is a hardware security key that adds an extra layer of protection to your online accounts, including financial ones. It offers secure two-factor authentication and safeguards your sensitive information from phishing and unauthorized access.

YubiKey is known for its versatility, as it works with a wide range of online services and applications. It’s a physical device that you plug into your computer or mobile device to confirm your identity when logging in. This significantly reduces the risk of unauthorized access, as even if someone obtains your login credentials, they would still need physical access to your YubiKey for authentication.

For individuals who prioritize the security of their financial accounts and personal information, YubiKey is an invaluable tool.

Future-Proofing Your Finances

In the final chapter, we’ll discuss the importance of future-proofing your finances by embracing emerging technologies and trends. We’ll also provide tips on integrating these gadgets seamlessly into your financial routine.

Future-Proofing Your Finances

The world of finance and technology is constantly evolving. To future-proof your finances, consider the following tips:

- Stay Informed: Continuously educate yourself about new financial technologies and trends. Subscribe to financial news outlets, follow industry blogs, and join online forums or communities to stay updated.

- Diversify Investments: Diversification remains a key principle of investing. Consider diversifying your investment portfolio across different asset classes and geographic regions to reduce risk.

- Regularly Review Goals: Financial goals can change over time. Regularly review and adjust your goals as needed. Make sure your financial gadgets align with your current objectives.

- Automate Where Possible: Automation can simplify your financial life. Set up automatic transfers to savings or investment accounts and schedule bill payments to avoid late fees.

- Embrace Cryptocurrency: Cryptocurrencies are gaining popularity as alternative investments. If you’re interested in exploring this space, do your research and consider adding cryptocurrencies to your portfolio.

- Use Financial Apps: Consider using financial apps that offer a holistic view of your financial health. Many apps can aggregate data from various accounts and provide insights into your overall financial situation.

- Seek Professional Advice: Depending on your financial complexity, consulting with a financial advisor or planner can provide valuable insights and guidance.

Chapter 9: Availability and Security of Finance Gadgets

Ensuring the availability and security of your finance gadgets is crucial for a seamless and safe financial management experience. In this chapter, we’ll delve into the factors that contribute to the availability and security of these gadgets.

Availability of Finance Gadgets

- Platform Compatibility: Check whether the finance gadgets you intend to use are compatible with your devices and operating systems. Most gadgets offer mobile apps for iOS and Android, but some may have limitations.

- Internet Connection: Finance gadgets typically require an internet connection to sync data and provide real-time updates. Ensure you have a stable internet connection to access your financial information whenever you need it.

- Service Reliability: Research the reliability and uptime history of the service providers behind these gadgets. Downtime or service interruptions can disrupt your financial management routine.

- Backup and Recovery: Explore whether the gadgets offer backup and data recovery options. Regularly back up your financial data to prevent loss in case of technical issues or device failures.

Security of Finance Gadgets

- Password Protection: Use strong, unique passwords for your gadget accounts. Many gadgets offer multi-factor authentication (MFA) options, such as one-time passwords or biometrics, to enhance security.

- Data Encryption: Ensure that the data transmitted and stored by finance gadgets is encrypted using robust encryption protocols. This protects your sensitive financial information from unauthorized access.

- Security Updates: Keep your gadgets’ apps and software up to date. Developers often release updates to address security vulnerabilities, so regularly installing these updates is essential.

- Secure Connections: Verify that your gadgets establish secure connections when interacting with financial institutions or cloud servers. Look for HTTPS in the URL and check for SSL/TLS encryption.

- Privacy Settings: Review and adjust the privacy settings within your finance gadgets. Some apps may collect and share data for analytical purposes; configuring these settings can protect your privacy.

- Authentication Methods: If available, consider using biometric authentication (e.g., fingerprint or face recognition) for added security when accessing your financial information.

- Secure Device Use: Protect the physical security of your devices. Use PINs, patterns, or biometrics to lock your smartphone and other devices, and never leave them unattended in public places.

- Phishing Awareness: Be vigilant about phishing attempts. Criminals may impersonate finance gadgets to steal your login credentials. Always verify the legitimacy of the app or website.

- Account Recovery: Familiarize yourself with the account recovery options provided by your finance gadgets. This is crucial in case you forget your password or lose access to your account.

- Financial Institution Security: Verify that the financial institutions you connect with through these gadgets have robust security measures in place. Check for two-factor authentication options and alerts for suspicious activity.

- Privacy Policies: Review the privacy policies of the gadget providers to understand how your data is collected, used, and shared. Choose gadgets from providers with transparent privacy practices.

- Data Access Permissions: Pay attention to the permissions requested by finance gadget apps on your mobile devices. Only grant access to the data necessary for their functionality.

By prioritizing accounts availability security features pros that you can use finance gadgets with confidence, knowing that your financial information is protected and readily accessible when needed. Remember that maintaining a balance between accessibility and security is key to a successful financial management experience.

Conclusion

In this guide, we’ve explored a range of finance gadgets designed to help you take control of your financial well-being. From budgeting to investing, standout features categorizes your expenses, these gadgets offer solutions for every aspect of your financial life.

Mint Budgeting App

Our top pick for the best finance gadget is the “Mint Budgeting App.” With its comprehensive budgeting features, user-friendly interface, and bank-level security, Mint is the ultimate tool for achieving financial wellness.

By incorporating these finance gadgets into your daily life, you can streamline your financial management, make more informed decisions, and work toward your financial goals with confidence. Embrace the power of technology to boost your financial well-being and secure your financial future.

Remember, financial success begins with smart choices, and these gadgets are your partners on the path to financial greatness. Start exploring, start optimizing, and start building a brighter financial future today!

FAQ: Your Comprehensive Guide to Finance Gadgets

Q1: What are finance gadgets, and why should I use them?

A1: Finance gadgets are technological tools designed to help you manage your finances more efficiently. They offer benefits like automation, accuracy, financial insights, and security, making them essential for modern financial management.

Q2: Which finance gadget is best for budgeting?

A2: Our top pick for budgeting is the “Mint Budgeting App.” It tracks income, expenses, and financial goals effortlessly, provides real-time insights, and offers valuable suggestions for improving your financial health.

Q3: How can Acorns help me with investing?

A3: Acorns is a micro-investment app that rounds up your everyday purchases to the nearest dollar and invests the spare change in diversified portfolios. It offers various investment options to align with your financial goals.

Q4: What does Expensify offer for expense tracking and tax management?

A4: Expensify simplifies expense tracking and reporting, allowing you to scan receipts, track mileage, and categorize expenses with ease. It streamlines the process of managing expenses and aids in tax preparation.

Q5: Can Credit Karma really help improve my credit score?

A5: Yes, Credit Karma offers free access to your credit scores, credit reports, and personalized credit improvement tips. By following its recommendations, you can take proactive steps to boost your creditworthiness.

Q6: How can I benefit from the Investopedia Finance Learning App?

A6: Investopedia provides articles, tutorials, and quizzes on various financial topics, catering to individuals at all levels of financial knowledge. It’s a valuable resource for enhancing your financial literacy.

Q7: Why is the YubiKey Security Key important for financial security?

A7: The YubiKey adds an extra layer of security to your online financial accounts through secure two-factor authentication. It protects your sensitive financial information from phishing and unauthorized access.